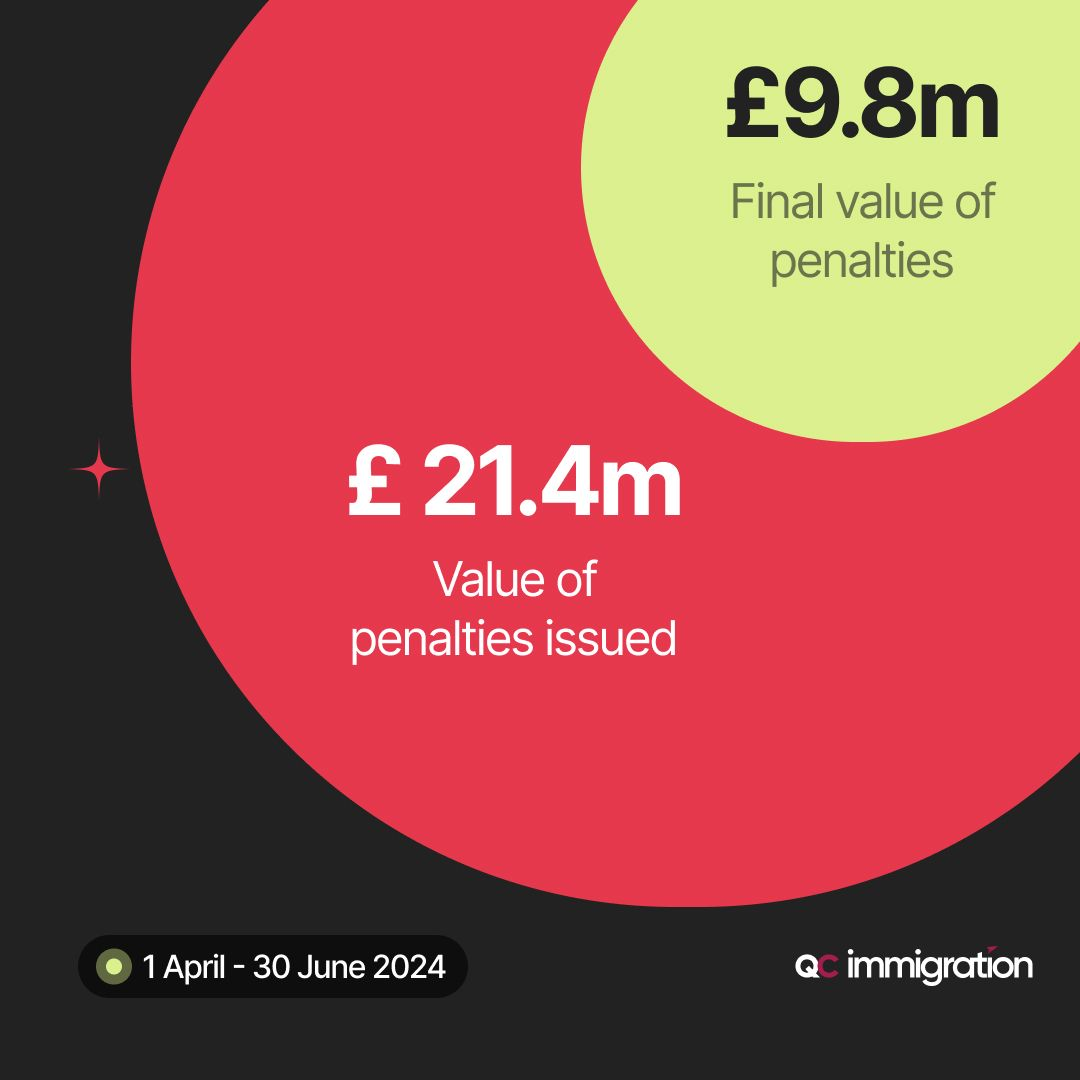

On October 31st 2024, the UK government released its most recent data on illegal working civil penalties between 1 April and 30 June 2024.

These penalties are issued to employers who fail to ensure their employees have the legal right to work in the UK.

Key Numbers from Q2 2024 (April – June)

Total fines issued: £21.4 million (based on total fine amounts).

Number of penalties issued: 568.

Number of illegal workers identified: 861.

Changes to Data Publication

A significant change was made in how this data is presented. Earlier, penalties were reported with a regional breakdown, but the government has now moved to a national aggregate format. The regional insights shared here have been inferred from the list of fines previously published.

Regional Breakdown

London & South East England: £2.86 million (79 fines).

Midlands & East England: £3.29 million (87 fines).

North East, Yorkshire & Humberside: £804k (21 fines).

North West England: £765k (28 fines).

Scotland & Northern Ireland: £740k (17 fines).

Wales & South West England: £1.29 million (30 fines).

Understanding Illegal Worker Fines

Illegal working fines are imposed when employers fail to perform required “right-to-work” checks or knowingly hire individuals who do not have the right to work in the UK. The penalties for non-compliance are now:

First offence: A minimum of £45,000 per illegal worker.

Subsequent offences: Up to £60,000 per illegal worker.

The increased fines, introduced earlier in 2024, reflect the government’s stronger stance against illegal employment practices.

Why Do Civil Penalties Get Issued?

Under UK law, employers are required to conduct, verify, and document right-to-work checks for their employees. Failure to perform these checks diligently or deliberate non-compliance can result in hefty penalties.

The rise in fines this quarter demonstrates the Home Office’s continued work to ensure compliance and protect the integrity of the UK’s immigration system.

Implications for Employers

The escalating fines and increased enforcement signal a clear warning to businesses. To avoid penalties:

- Conduct rigorous checks: Verify every employee's documentation.

- Keep detailed records: Maintain robust and accurate right-to-work documentation.

- Stay informed: Regularly update processes to align with changing laws.

- Seek professional guidance: For businesses unsure of their compliance status, legal and immigration experts can provide support.

Conclusion

The rise in penalties in Q2 2024 highlights the growing focus on preventing illegal working. Employers must prioritise compliance to avoid fines, operational disruption, and reputational damage.

As regulations tighten, QC Immigration offers expertise to help businesses stay compliant with the Sponsor Licence requirements, conduct thorough right-to-work checks, and maintain a strong audit trail to ensure businesses prevent illegal working.

Follow us for more insights and updates on immigration enforcement trends.