Table of contents

Share

Are you wondering what the Partner Visa financial requirements are? For most Partner Visa applications under the 5-year route, we often find that the most difficult and time-consuming preparation surrounds the financial documents.

Understanding the financial requirements as laid out in the Appendix FM can be quite daunting and complicated. Strict criteria must be met, and prescribed evidence must be provided. Each application may differ slightly due to the uniqueness of each individual case, and occasionally there are exceptions.

However, the Home Office may be rigid and failing to fulfil this requirement usually results in the refusal of visa applications. Below is a breakdown of all the key points for the financial requirements of family members’ applications.

Which applicants does this apply to:

- Spouse Visa

- Unmarried & Same-sex Partner Visas

- Civil Partner Visa

- Fiancé / Fiancée Visa

- Proposed Civil Partner Visa

What type of applications does this apply to:

- Entry clearance applications

- Leave to Remain (Initial or Extension) applications

- Indefinite Leave to Remain applications

You are usually applying as a dependent (e.g. a partner or child) of a Sponsor who is either already a British or Irish citizen, or is present and settled in the UK, or is in the UK with refugee leave or humanitarian protection. ‘Partner’ means an applicant’s fiancé(e), civil partner, proposed civil partner, spouse, unmarried partner or same-sex partner.

How much money do you need for Partner Visas?

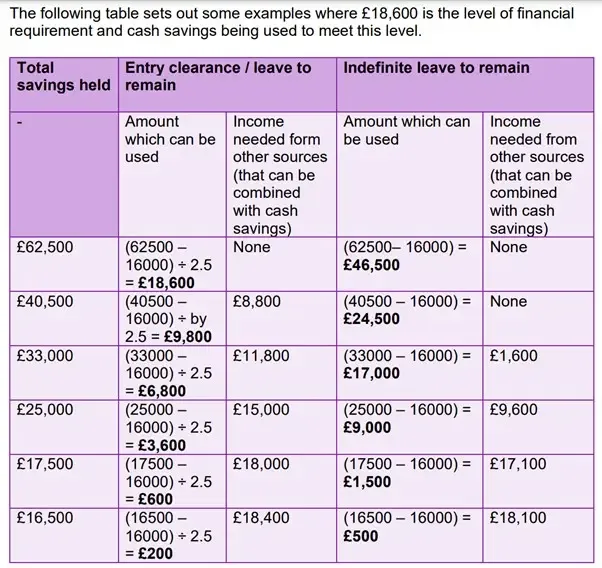

The minimum income threshold under Appendix FM is £18,600. However, this can increase depending on whether any children are sponsored in the application:

- Partner with no children: £18,600

- Partner plus one child: £22,400

- Partner with two children: £24,800

- Partner with three children: £27,200

(As well as £2,400 for each additional child).

How do you meet the Partner Visa financial requirements?

- Minimum income threshold (£18,600)

- Specified savings (starting from £16,000)

- Adequate maintenance e.g. carer’s allowance, disability living allowance, severe disablement allowance

What financial resources can you show?

- Income from salaried or non-salaried employment of the applicant if they are in the UK with permission to work, and/or their partner - depending on the employment history, this can be referred to as category A or B.

- Non-employment income, for example, income from property rental or dividends from shares - referred to as category C.

- Cash savings of the applicant and/or their partner, above £16,000, held by the applicant and/or their partner for at least 6 months, and under their control - referred to as category D.

- State (UK or foreign), occupational or private pension of the applicant’s partner and/or the applicant - referred to as category E.

- Income from self-employment, and income as a director or employee of a specified limited company in the UK, of the partner (and/or the applicant if they are in the UK with permission to work) - on which financial year(s) is or are being relied upon, this can be referred to as category F or G.

Of all the above sources, we find that clients are often confused by the calculations for cash savings. See below the current calculations to determine if your cash savings are adequate to meet the minimum income threshold.

Can you combine financial resources?

Certain combinations may be allowed, while some resources may only be used on their own. This needs to be checked against each source, and we must also ensure that the periods combined are compliant.

Which financial resources cannot be used?

Income from the following sources will not normally be counted towards the financial requirement:

- Loans and credit facilities

- Child benefit or child tax credit

- Universal credit

- Working tax credit

- Unemployability allowance, allowance for a Lowered Standard of Occupation and invalidity allowance under the War Pensions Scheme

- Income-related benefits such as income support, income-related employment and support allowance, pension credit, housing benefit, council tax benefit or support (or any equivalent), and income-based jobseeker’s allowance

- Income from others who live in the same household (except any dependent child of the applicant who has turned 18 and continues to be counted towards the higher income threshold the applicant has to meet until they qualify for settlement)

- Financial or subsidy support from a third party (other than child maintenance or alimony payments, academic maintenance grants/stipends or gifts of cash savings that meet the requirements specified in paragraph 1(b) of Appendix FM-SE, except where paragraph GEN.3.1. of Appendix FM and paragraph 21A of Appendix FM-SE apply

- Contributory benefits such as contribution-based jobseeker’s allowance, contribution-based employment and support allowance, and incapacity benefit

- Any other source of income not specified in Appendix FM-SE as counting towards the financial requirement

Partner Visas financial requirements exceptions

In general, we find that the Home Office applies a strict approach when considering your financial documents and information. The Home Office may apply Evidential Flexibility if there are very minor omissions that do not affect the merits of the case - however, this applies in very limited circumstances.

There is also a Coronavirus concession in place where there is evidence of a temporary loss of income due to COVID-19, from 1 March 2020 to 31 October 2021. Furthermore, income received via the Coronavirus Job Retention Scheme or the Coronavirus Self Employment Income Support Scheme can count as employment or self-employment. This ensures Partner Visa applicants are not disadvantaged as a result of circumstances beyond their control because of COVID-19.

Exemption from the financial requirement may apply when the minimum income threshold cannot be met, but there are exceptional circumstances that mean a refusal of an application could result in unjustifiably harsh consequences for the applicant, their partner or a relevant child(ren). This can result in decision makers considering other credible and reliable sources of income.

We may consider applying under the 10-year Partner Visa route instead, if the application does not meet the financial or English test requirements. However, each case must be assessed based on its own merits, with comprehensive evidence and the human rights legal arguments it may rely upon. For example, if there are settled children involved or compassionate circumstances.

No matter how complex your case may be, our team has extensive experience in Partner Visas applications and financial requirements. Please book a confidential consultation with us to discuss further.

Resources:

https://www.gov.uk/guidance/immigration-rules/immigration-rules-appendix-fm-family-members